We Bought Texas Roadhouse: $TXRH - Malevolent Missy Stock Series #57

Missy is on her way to financial independence. See what she is buying now!

For those of you who followed my old blog starting in 2017 at FreddySmidlap dot com I closed that website and domain in summer of 2023. I was tired of paying for hosting on an unprofitable enterprise but really liked writing the Malevolent Missy Investing Series. So I moved my old posts over here instead of just tossing them aside. Most of the graphics got lost for the old posts and that is a shame but the text remains (I think). Missy and I still think QQQ is the best index for your long term investing dollars and we will continue to learn and grow by buying one stock near the middle of each month. Today marks month number 52 in the series.

Missy’s portfolio is back in the green and closing the gap!

Today we bought restaurant company Texas Roadhouse for the second time. We (both Missy and I in our personal portfolio) bought TXRH a couple of months ago in March of 2024. The more I think about what kind of assets I want to own the more I think about Texas Roadhouse as fitting into our portfolios. The company is growing but at a reasonable rate while remaining very profitable.

Did you ever want to know how to build a successful stock portfolio from scratch?

Since fall of 2019 Malevolent Missy is doing just that and proving the naysayers wrong. Those are the same naysayers who say you cannot beat a diversified low cost index fund like VTSAX with individual stocks so you should not even try. Not all of Missy's buys will turn out to be life-changing as far as returns but some probably will. We fully expect some mistakes along the financial Yellow Brick Road but we just keep buying. Whether you prefer index fund investing or individual stocks you should just keep buying too!

This month we bought Texas Roadhouse TXRH 0.00%↑

First, here is a quote for Texas Roadhouse stock from Yahoo! finance TXRH stock quote

I encourage any and all stock investors to learn their way around these quote pages on the Yahoo! machine.

Oh, and if you've been following along you will remember real-life Malevolent Missy moved on to greener pastures and a new job that came with a major pay increase in early 2022. So, just like in real life, she increased the amount of her monthly stock buys from $1,100 to $1,500!

Here is the summary for the month. We bought PGR Stock

Texas Roadhouse, TXRH: 9.08 shares @ $165.15 = $1500 on 5-13-24

For our scorecard comparisons we also bought our usual equal $1500 amounts of the Nasdaq 100 index (QQQ) and the Vangard Total Stock Market ETF (VTI).

QQQ: 3.38 shares @ 443.22 = $1500

and

VTI (VTSAX, ETF equivalent): 5.81 shares @ $258.30 = $1500

Remember everybody: none of this is a recommendation to buy any particular securities, stocks, or funds. I am not a finance professional. Do your own research and take responsibility for your own money decisions. It's called independent thought and it is a glorious thing. This is merely an example of one way to try and build a winning stock portfolio.

This is Missy’s second time buying TXRH shares. The company keeps growing and I believe taking market share. One thing I like about the growth is they have concentrated on the heartland of the United States and seem less concerned with what the “coastal elite” do for dining options. I have never been to one of their restaurants but people I talk to who patronize them love the place.

The company is free cash flow positive has a high return on equity for years. They have returned a sweet 18.7 CAGR since 2017 plus they are buying back shares and tossing owners a 1.35% dividend yield to boot. They most exciting part of the story for me is in this article: Texas Roadhouse picks up the pace for its Jaggers concept. Jaggers is the fast food concept the company is bringing along slowly. Right now they only have 8 of them open and I like this conservative approach. The dearly departed founder, Kent Taylor described it like this: “a place that would have better burgers than Five Guys, and serve chicken tenders and sandwiches that could compete with Raising Cane’s and Chick-fil-A.” If they nail the fast food concept then watch out!

I bought more shares today in our Smidlap Portfolio as well.

If you did not know or you forgot we own every one of The Missy Series Stocks in our own portfolio

The runners up this month buy.

Today’s runner up buy is Adobe stock. They are selling for 25% off their 52 week high and just this spring authorized a $25 billion share buyback over the next few years. That amount represents 20% of the current market cap and they have plenty of cash flow for the transactions. In the trailing 12 months they generated $6.3 billion in free cash flow on revenue of $20 billion for a roughly 33% free cash flow margin. The company is a powerhouse and I would rather they return capital to shareholders through a massive buyback rather than initiating a dividend.

Check out our exclusive Stock evaluation sheet in Google sheets. It has a wealth of information on some of the greatest compounding companies in the world. Seriously, if you want to look for great companies, start building a core of those with a proven track record.

Regardless of what we did not do there is always another buying opportunity next month! There is no missing out. Try not to get too eager to get rich quick and just stick to the plan, man.

Malevolent Missy's Long Term Results and Holdings

Although Missy is still lagging the index funds her portfolio is starting to close the gap and hopefully return to its former glory. Just a quick look back at the green line in the graph around February of 2021 shows how much growth can outperform but when it falls out of favor look out below!

Our youthful heroine Malevolent Missy buys one stock per month as she works towards her own financial independence. The key for her is to buy stocks and invest consistently as she builds her winning stock portfolio. She is a real financial lumberjack with the behavior of calm consistency. Here are her results against QQQ and VTSAX

We are building Missy a successful stock portfolio from the ground up in real time

Each month we'll buy an equal $1500 amount of one stock and the same amount of the two index funds, VTSAX and QQQ. The first 12 months our gal was investing $1000/month in one stock and the same in VTSAX in her work retirement account. With her recent raise and promotion she decided to raise those amount to $1500. Any person getting that same raise should consider doing the same as they make more money. Enjoy some of that raise now and invest a little extra too. Don’t be a miser with all of your money, just keep steadily investing and patiently watch the pie grow

We got some individual picks wrong but we were right so far about QQQ!

The Nasdaq 100 index (QQQ) is absolutely clobbering the beloved VTSAX total stock market index so far after more than four years. I think our individual holdings will eventually catch VTSAX in performance but I am not so sure about catching QQQ.

Reminder: We personally own all of Missy’s holdings in our own Smidlap Portfolio

Basically we are buying stocks in real time without any smoke and mirrors or "what if's" like looking backward. Everybody knows it would have been great to buy Amazon stock back in 2002, but what good does that do when we look forward? I'll repeat this part: We also own all of the Missy Series stocks in our Smidlap Portfolio. So our own real money is on the line and it's not just a theoretical stock market game lasting only a short time. This is lifetime investing and hopefully shows what it's like for a young retail investor going through market ups and downs.

Real Money Results - This Hits Home Better Than Percentages!

Like I said Missy is now lagging the benchmark QQQ and VTSAX fund average returns with her stock picks but her portfolio is closing the gap. The dollar growth is very instructive as the scorecard shows the QQQ’s beating the VTSAX by 44% to 28% but look the difference in dollars gained! the gain of QQQ is $11,000 more over 4.5 years.

She is only 28 years old though and has time to wait for her future stars to bounce back as far as stock prices. Most of the stocks with beaten down prices are still doing fine as companies and the prices don't always reflect that future growth potential. When growth falls out of favor look out below and hold on tight! I don’t know if she will ever catch the QQQ’s but beating VTSAX should happen before too long.

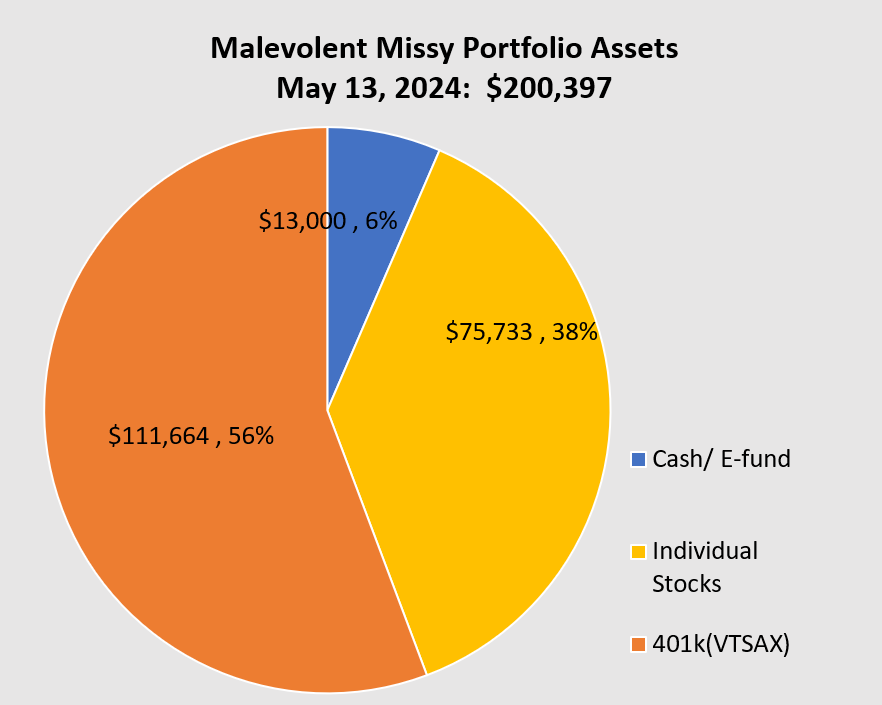

Always look at the total assets- Our gal has eclipsed a $200k portfolio in just over 56 months!

$200,000 is a huge chunk of money for a young employee! And our gal achieved this in just over 4 years. Anyone should be excited to approach a milestone like that. Missy will have a huge advantage for having started so young with her investing. Can you see how a young person can really start to build wealth just by starting and steadily contributing?

She has plenty in her emergency fund and a nice percentage of her individual stocks in a Roth IRA. Those tax free withdrawals from the Roth will be terrific with her long time horizon to grow those assets.

Also, Missy can afford to be patient with her individual stock holdings when she takes a look at her total asset pie. She still has plenty of index funds (VTSAX) in her 401k and when growth stocks falter those index funds cushion the blow in overall asset accumulation.

Remember, we have a long time horizon for our investments!

What Missy owns

Maybe we overpaid for a few of these holdings in the past but a portfolio something like this should do quite well going forward from these levels.

These are all the stocks Missy has sold from her portfolio

Sometimes you just have to admit when you were wrong and take out the trash. Anyhow, hindsight is always 20-20 but it’s worth keeping track and reminding yourself that patience is often rewarded.

I am excited in thinking I figured out how to share Missy's holdings as a Google Spreadsheet. Here's a link in case you want to take a deeper dive. Link to Google Spreadsheet of Missy's Portfolio. This link updates essentially in live time.

Feel free to save yourself a copy of any of these Google Sheets and modify them any way you please.

We keep score against VTSAX because that index is so common for many personal finance blowhards to recommend. You might recognize some of the blowhards swimming in the Reddit cesspool and waxing eloquently about a subject where many have never accomplished anything. They just parrot whatever they heard from an internet guru onto a screen and call themselves an "expert."

You can see that our gal has made 56 buys totaling $71,200. As of May 13, 2024, only 19 of her 41 current holdings are beating the VTSAX index. We both learned some lessons and keep the faith that we will eventually outperform the index funds over a long period.

Late 2021 and all of 2022 were horrible years for growth stocks and our gal is fortunate to have a long time horizon. 2022 was worse for growth but there are signs things have stabilized for those assets. This is where being consistent and realizing this decline shall pass can pay massive future financial dividends. Our gal just keep on chopping that wood.

How do you feel about Texas Roadhouse stock as a long term winner?