The Smidlap Portfolio has its First 100 Bagger Stock... Nvidia!

What I have learned along the way

What is a 100 bagger stock?

A 100 bagger is a stock whose value has risen 100 times from the original purchase price. Today I’ll walk you through why we initially added the shares to the portfolio, the roller coaster ride in holding them, and the psychology of continuing to own shares that have risen so far and fast. But first, let me clearly state the first 100 bagger for anyone is bound to induce a case of the jollies! It’s comparable to the first time getting laid and that’s really something in my book.

The History

When I first bought a Motley Fool Stock Advisor service in early 2016 Nvidia was one of the first recommended stocks I purchased. Back in those days NVDA got the bulk of their revenues from selling graphics cards for computer applications like video games and porn. They were clearly the best at what they did but if they remained only a seller of GPU’s (graphics chips) for one major industry they would not have grown to the size they are today. The company back in 2016 had a couple of traits that made them attractive: The first was their foray into early autonomous driving applications. The second was more optionality in the future of heavy computing like data centers and artificial intelligence.

In a further stock recommendation in January, 2017 Motley Fool’s cofounder (and best stock picker) David Gardner wrote something I consider especially prescient. Most of the recommendation was about the quality of the graphics business and growing automotive segment. But among those sound points was a little blurb that really resonated with me. “But GPU is also key to deep learning and artificial intelligence.” That one sentence really got my attention. I knew we were not “there yet” with these applications but figures that could be big business in the future for Nvidia. I would have bought the shares regardless of the promise of being a future giant but that possibility sealed the deal for me.

The Good and Bad Moves Along the Yellow Brick Road to Riches

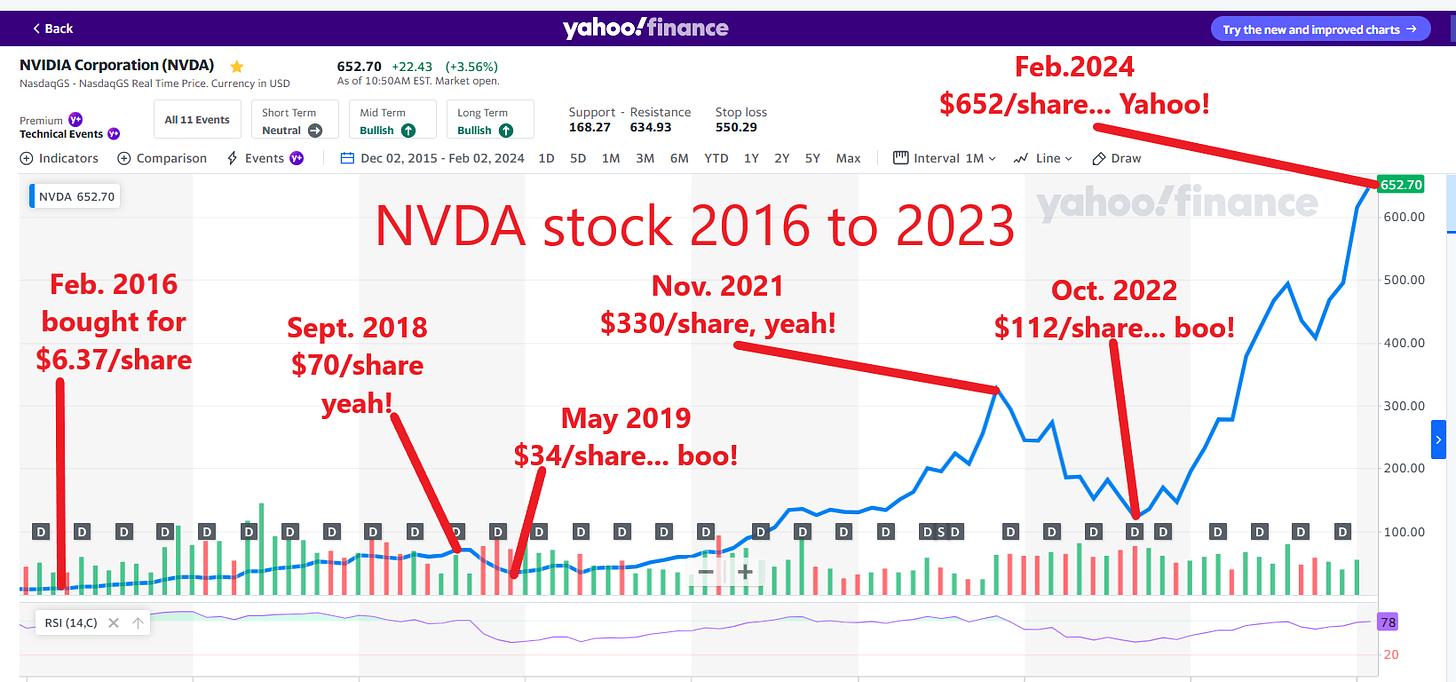

Note: all stock prices mentioned are split-adjusted. For instance, I initially paid $25/share back in 2016 but the stock split 4:1 in summer of 2021 so I refer to that purchase price as $6.37.

So, I bought our first shares (the 100 bagger ones) on Feb. 9, 2016 for $6.37. I added more shares 3 times in May and June at $8.77, $10.89, and $11.95. Then I did something costly: I sold about 30% of our position (the original shares had doubled) for about 14 bucks. Let me remind you that today’s prices is $650/share. I don’t know if I realized my mistake but I bought most of those shares back a few months later for about $23. Then I just held the shares for a roller coaster ride for the next 7-8 years. The ride looked like this:

By the time 2018 I was feeling pretty smug and smart when the initial shares were a 10 bagger around $70. Then some non-event happened and the price was cut in half in a matter of months. Doh! I bought some more (a very small amount) in 2019 for $45/share. Then we were feeling very smug and smart rolling into the fall of 2021 with a 50 bagger and WHAM! The great growth stock massacre of 2021/2022 happened and NVDA lost about 2/3 of their value in less than a year. The bleeding was worse for our other blockbuster stock, Shopify, which lost more like 75% of their value in that same time period.

What is the lesson?

The lesson for me is something like this: You think you have big titanium balls and I really was mentally prepared for 20-30% pullback. When your oversized positions take a huge hit like they took it really is jarring though. For my money I now like to have a big handful of about 10-12 high quality safety stocks to mitigate some of the pain. I consider safety stocks to be steady Eddy boring companies like Auto Zone, Transdigm, Old Dominion Freight Line. Throw in some iron-clad retailers like Costco and some insurance businesses like United Health and Arthur J. Gallagher and you’ll sleep better at night when your growth stocks go deep into the tank. Some of those growth stocks that rages up until late 2021 are never coming back but as you can see NVDA is all the way back and then some. Shopify is about half-way back. The big lesson is not to panic and sell when the shit hits the fan. We held on and it paid off beyond expectations.

The other move you can make is to set a type of maximum percentage that any stock can be of your overall assets. In my opinion you should always look at a comprehensive picture of assets, when they are funds in a 401k, rental real estate, or stocks in a brokerage account. For instance, even with our 100 bagger NVDA success those shares make up about 30% of our total individual stocks and about 20% of our overall assets. I am presently OK with that risk but others might want to be a bit more conservative “take some off the table” with a big success. The problem is you can cost yourself a lot of money to rotate into something with less upside. Much of this depends on a person’s age and overall situation. In our house we are 2 years and 6 years away from social security age with a pretty good cushion if NVDA share price was cut in half again. We would not be forced to subsist on tree bark and dog food if that happened.

I must admit I did sell some shares in the course of 2023 as part of funding Mrs. Smidlap’s retirement paycheck. I sold the shares well below today’s share price but here is the reason I do not regret those sales: The whole point of saving and investing was to eventually enjoy the fruits of your successes. We enjoyed the proceeds of those sales to fund our lives! But… if we were much younger as investors I would encourage to just hold on tightly to your best shares until a few years from retirement.

As a final note NVDA revenue was about $5 billion back in 2016 and is more like $50 billion today and their free cash flow is up about 15x, in case you wonder what drives stock prices. Does all this smell a little overvalued? To me it does and I don’t know if I would have the nuts to add shares at this level. But, I am in no rush to sell it all, either.

You can get your own 100 baggers but it will probably take longer than 8 years

For the mathematically challenged a 100 bagger in 8 years is a CAGR (compound annual growth rate) of 77% per year. But don’t fret, you can always check out this list of fantastic companies and check out what certain long term growth rates yield over time. Smidlap CAGR Analysis Sheet. There is one trucking company called LandStar Systems on the sheet which is a 105 bagger over the past 30 years. That CAGR equated to about 17% per year, which is excellent. If your portfolio can grow 17% on average and you have some time on your side you can get pretty darned wealthy. For one more example, Dutch chip equipment maker ASML is a 294 bagger over only 28 years. You would expect their CAGR to double what LandStar achieved but ASML’s was “only” 22.5% for 28 years. See what a difference a percentage or two can make over the long life of a holding?

We Always Celebrate Our Wins with a Victory Lap

I think I am going to sell a share today and go out and buy a special celebration bottle of wine. I think you should always celebrate your wins, big or small. If you don’t then why do you bother winning?

note 2: we own all the stocks mentioned above in our portfolio except LandStar and Costco. None of this is a recommendation to buy or sell any security. I just want to present some examples of what has worked and what has not for us. I am not a financial professional but I did eat paste in elementary school.